Bitcoin Price Prediction Using Machine Learning Techniques

DOI:

https://doi.org/10.54060/JIEEE/003.01.005Keywords:

Bitcoin, Prediction, Time-Series, Predictive Model, Deep Learning, Long-Short Term Memory, Recurrent Neural Network, Real-time Data, Mean Absolute Error, AccuracyAbstract

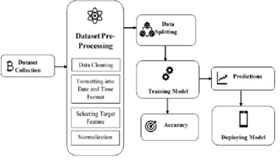

This paper discusses, trying to accurately assess the price of Bitcoin by looking at differ-ent parameters affects the value of Bitcoin. In our work, we focus on understanding and seeing the evolution of Bitcoin daily market, a1 and gaining intuition in the most rele-vant aspects surrounding the Bitcoin price. In the meantime, market capitalization of publicly traded cryptocurrencies exceeds $ 230 billion. The most important cryptocur-rency, Bitcoin, is used primarily as a digital value store, and its pricing opportunities have been extensively considered. These features are described in more detail in the fol-lowing paragraph: details of the main Bitcoin, as described in the paper. Bitcoin is the most expensive digital currency in the market. However, Bitcoin prices have been highly volatile, making it difficult to forecast. As a result, the goal of this research is to find the most efficient and accurate model for predicting Bitcoin prices using various machine learning algorithms. Several regression models with scikit-learn and Keras libraries were tested using 1-minute interval trading data from the Bitcoin exchange website bit stamp from January 1. 2012 to January 8, 2018. The best results showed a Mean Squared Error (MSE) as low as 0.00002 and an R- Square (R2) as high as 99.2 percent.

Downloads

References

G. Neil, H. Halaburda. “Can we predict the winner in a market with network effects? Completion in cryptocurrency market,” Games, vol.7 no.3, 2016, pp.16. vol.7 no.3, 2016, pp.16. cryptocurrency market,” Games, vol.7 no.3, 2016, pp.16.

N. Mangla and P. Rathod, “Unstructured data analysis and processing using Big Data tool -Hive and machine learning algorithm -linear regression,” Iaeme.com. [Online]. Available: https://iaeme.com/MasterAdmin/Journal_uploads/IJCET/VOLUME_9_ISSUE_2/IJCET_09_02_006.pdf. [Accessed: 27-Mar-2022]

P. Melville and V. Sindhwani, “Recommender Systems,” in Encyclopedia of Machine Learning and Data Mining, Boston, MA: Springer US, 2017, pp. 1056–1066.

S. Kumar et al., “Novel method for safeguarding personal health record in cloud connection using deep learning models,” Comput. Intell. Neurosci., vol. 2022, p. 3564436, 2022.

A. Singh, P. Singh (2020) Image Classification: A Survey. Journal of Informatics Electrical and Electronics Engineering, Vol. 01, Iss. 02, S. No. 2, pp. 1-9, 2020.

S. Yadav, P. Singh (2020) Web Application and Penetration Testing. Journal of Informatics Electrical and Electronics Engineering, Vol. 01, Iss. 02, S. No. 3, pp. 1-11, 2020.

A. K. Sahani and P. Singh, “Web Development Using Angular: A Case Study”. Journal of Informatics Electrical and Electronics Engineering, Vol. 01, Iss. 02, S. No. 5, pp. 1-7, 2020.

L. Buitinick, G. Louppe, M. Blondel, F. Pedregosa, A. Mueller, O. Grisel, V. Niculae, P. Prettenhofer, A. Gramfort, J. Grobler, R. Layton, J. Vanderplas, A. Joly, B. Holt, and G. Varoquaux, “API design for machine learning software: experiences from the scikit-learn project,” arXiv preprint arXiv:1309.0238, 2013.

M. Devin, R. Monga, S. Moore, D. Murray, C. Olah, M. Schuster, J. Shelns, B. Steiner, I. Sutskever, K. Talwar, P. Tucker, V. Vanhoucke, V. Vasudevan, F. Viegas, O. Vinyals, p. Warden, M. Wattenburg, M. Wicke, Y. Yu and X. Zheng “Tensorflow: Large-Scale machine learning on heterogeneous distributed systems,” arXiv preprint arXiv: 1603.04467, 2016.

S. Squarepants, “Bitcoin: A peer-to-peer electronic cash system,” SSRN Electron. J., 2008.

E. Feyen, J. Frost, L. Gambacorta, H. Natarajan, and M. Saal, “Fintech and the digital transformation of financial services: implications for market structure and public policy,” Bis.org, 2021. [Online]. Available: https://www.bis.org/publ/bppdf/bispap117.pdf. [Accessed: 27-Mar-2022].