Stock Price Prediction using ML and LSTM based Deep Learning models

DOI:

https://doi.org/10.54060/JIEEE/003.01.008Keywords:

Stock Price Prediction, Regression, Long Short-Term Memory, Multivariate Time Series, Linear Regression, Support Vector Machine, Random Forest, walk Forward ValidationAbstract

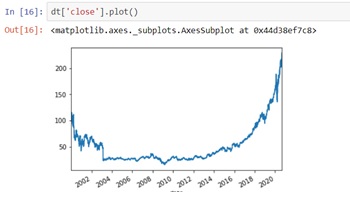

Stock Price Prediction has become an important area of research for such a very long time. A lot of research has already been made to predict the stock in a best possible manner and to gain more profit from that , Now adays some market hypothesis believe that it is nearly very difficult to predict the stock price accurately but at the same time some machine learning techniques proved that choosing of right model and appropriate variables may lead to scenario where stock prices and their movement can be easily pre-dicted with great accuracy. Prediction of stock price becomes easy due to the introduc-tion of data mining techniques which helps the researchers to identify meaningful pat-terns and find the best possible results by working on the technical analysis of stock. In this research we have implemented some of the machine learning and deep learning techniques to gain more insights of varying stock prices with respect to time the purpose of introducing the Deep Learning model is that they can predict more accurate results as they are the advanced version of Machine Learning models. We have also compared these Machine Learning and Deep Learning models so that we can get the best possible model for our project.

Downloads

References

M. S. Yang, S. J. Chang-Chien and Y. Nataliani, “A fully-unsupervised possibilistic c-means clustering method,” IEEE Access, vol. 6, pp. 78308–78320, 2018.

J. MacQueen, “Some methods for classification and analysis of multivariate observations,” Proc. of 5th Berkeley Symposium on Mathematical Statistics and Probability, vol. 1, pp. 281-297, University of California Press, 1967.

D. N. Geary, G. J. McLachlan, and K. E. Basford, “Mixture models: Inference and applications to clustering,” J. R. Stat. Soc. Ser. A Stat. Soc., vol. 152, no. 1, p. 126, 1989.

A. P. Dempster, N. M. Laird and D. B. Rubin, “Maximum Likelihood from Incomplete Data via the EM Algorithm”, Journal of the Royal Statistical Society, Vol. 39, Iss. 1, pp. 1-38, 1977.

Z. Lv, T. Liu, C. Shi, J. A. Benediktsson and H. Du, "Novel Land Cover Change Detection Method Based on k-Means Clustering and Adaptive Majority Voting Using Bitemporal Remote Sensing Images," in IEEE Access, vol. 7, pp. 34425-34437, 2019, doi: 10.1109/ACCESS.2019.2892648.

E. Feyen, J. Frost, L. Gambacorta, H. Natarajan, and M. Saal, “Fintech and the digital transformation of financial services: implications for market structure and public policy,” Bis.org, 2021. [Online]. Available: https://www.bis.org/publ/bppdf/bispap117.pdf. [Accessed: 27-Jul-2022].

Y. Meng, J. Liang, F. Cao, and Y. He, “A new distance with derivative information for functional k-means clustering algorithm,” Inf. Sci. (Ny), vol. 463–464, pp. 166–185, 2018.

M. D. Buhmann et al., “Recommender Systems,” in Encyclopedia of Machine Learning, Boston, MA: Springer US, 2011, pp. 829–838.

A. Singh, P. Singh, “Image Classification: A Survey. Journal of Informatics Electrical and Electronics Engineering”, vol. 01, Iss. 02, S. no. 2, pp. 1-9, 2020.

N. Srivastava, U. Kumar and P. Singh, “Software and Performance Testing Tools. Journal of Informatics Electrical and Electronics Engineering”, Vol. 02, Iss. 01, S. No. 001, pp. 1-12, 2021.