Bitcoin and Cryptocurrency Exchange Market Prediction and Analysis Using Big Data and Machine Learning Algorithms

DOI:

https://doi.org/10.54060/jieee.2023.64Keywords:

Big data, Bitcoin, Machine Learning, PredictionAbstract

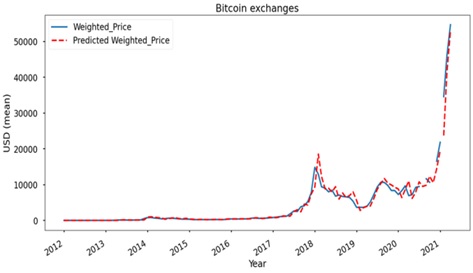

Due to economic uncertainty and the financial crisis of 2008, a desire for an unregu-lated currency arose, leading to the invention of Bitcoin. Using a pseudonym called Satoshi Nakamoto, Bitcoin was created in 2009, anonymously or by a group of un-known individuals. Since Bitcoin has been the most valuable cryptocurrency in recent years, its prices have fluctuated dramatically, making it difficult to predict their pric-es. Investors, businesses, risk managers, and market analysts can all benefit from being able to predict Bitcoin prices. By using the Bitcoin transaction data obtained from the Bitstamp website in this study, several different Machine Learning models are employed to determine the most accurate model for predicting Bitcoin prices. These models are based on 1-minute interval exchange rates in USD from January 1, 2012, to January 8, 2022. Analysis was performed primarily with Python, but it was also used and Hadoop, a distributed data storage and processing framework that uses the map-reduce programming model to allow efficient parallel processing of Big Da-ta. Based on the results of our research, comprising three experiments, autoregres-sive-integrated moving average (ARIMA) makes the most accurate prediction of Bitcoin prices, with a 95.98% success rate.

Downloads

References

B. B. Mandelbort, “When can price be arbitraged efficiently? A limit to the validity of the random walk and martingale properties, “Review of Economic Statistics, vol.53, no.3, pp.225–236, 1971.

E. F. Fama & K. R. French, “Permanent and temporary components of stock prices,” Journal of Political Economy, vol.96, no.2, pp.246–273, 1988.

A. W. Lo & A. C. Mackinlay, “Stock market prices do not follow random walks: Evidence from a simple specification test,” Review of Financial Studies, vol.1, no.1, pp. 41–66, 1988.

W. Brock, J. Lakonishok & B. L. Baron, “Simple technical trading rules and the stochastic properties of stock returns,” Journal of Finance, vol.47, no.5, pp.1731–1764, 1992.

S. Nadarajah & J. Chu, “On the inefficiency of Bitcoin,” Economics Letters, vol.150, no. C, pp.6–9, 2017.

P. Ciaian, M. Rajcaniova & d’Artis Kancs, “The economics of Bit Coin price formation,” Applied Economics, vol.48, no.19, pp.1799-1815, 2016

A. S. Hayes, “Cryptocurrency value formation: an empirical study leading to a cost of production model for valuing Bitcoin,” Telemat Information, vol.34, no.7, pp.1308-1321, 2016.

M. B. Taylor, Bitcoin and the age of bespoke silicon, In Proceedings of the International Conference on Compilers, Ar-chitectures and Synthesis for Embedded Systems, CASES’13. Piscataway, NJ, USA: IEEE Press, pp.1-10, 2013.

I. Magaki, M. Khazraee, L. V. Gutierrez et al., “ASIC clouds: specializing the datacenter. In Proceedings of the 43rd In-ternational Symposium on Computer Architecture, ISCA’16, pp.178-190, 2016.

O’ Dwyer KJ, Malone D. Bitcoin mining and its energy footprint,” Irish Signals & Systems Conference and China–Ireland International Conference on Information and Communications Technologies IET; pp.280-285, 2014.

H. Vranken, “Sustainability of Bitcoin and blockchains,” Current Opinion in Environmental Sustainability, Applied Economics, vol.28, pp.1–9, 2017.

P. Franco, “Understanding Bitcoin: Cryptography,” Engineering and economics, John Wiley & Sons, ISBN: 978-1-119-01916-9, pp.1-288, 2014.

S. Ranjan, I. Singh, S. Dua, et al., “Sentiment analysis of stock blog network communities for prediction of stock price trends,” Indian J Finance, vol.12, no.12, 2018.

F. Valencia, A. G. Espinosa, B. V. Aguire, “Price movement prediction of cryptocurrencies using sentiment analysis and machine learning,” Entropy vol.21, no.6, pp.1–12, 2019.

V. S. Pagolu, K. N. Reddy, G. Panda, et al., “Sentiment analysis of twitter data for predicting stock market movements,” Entropy, pp.1345-1350, 2016.

J. Abraham, D. Higdon, J. Nelson, et al., “Cryptocurrency price prediction using tweet volumes and sentiment analysis,” International Conference on Information and Communications Technologies, vol.1, no.3, pp.1-21, 2018.

S. Bird, E. Klein & E. Loper, Natural language processing with python: analyzing text with the natural language toolkit. O’Reilly Media USA, ISBN: 978-0-596-51649-9, pp.1-463, 2009.

S. Galeshchuk, O. Vasylchyshyn, A. Krysovatyy, “Bitcoin response to twitter sentiments. ICTERI workshops, pp.1-9, 2018.

B. Gunter, N. Koteyko, D. Atanasova, “Sentiment analysis: a market-relevant and reliable measure of public feeling,” Int J Mark, vol.56, no.2, 2014.

T. Phaladisailoed & T. Numnonda. Machine Learning Models Comparison for Bitcoin Price Prediction,” 10th Interna-tional Conference on Information Technology and Electrical Engineering (ICITEE), pp.506-511, 2018.

W. Chen, H. Xu, L. Jia, et al., “Machine learning model for Bitcoin exchange rate prediction using economic and tech-nology determinants,” International Journal of Forecasting, vol.37, no.1, pp.28-43, 2021.

S. A. Fattah, “Time Series Modeling for U.S. Natural Gas Forecasting, “Proceedings of International Petroleum Tech-nology Conference IPTC 10592, 2015.

R. Yu, G. Xue, V. T. Kilari, et al., “Coin Express: A Fast Payment Routing Mechanism in Blockchain-Based Payment Channel Networks,” 27th International Conference on Computer Communication and Networks (ICCCN) pp.1-9, 2018.

S. A. Rakhshan, M. S. Nejad, M. Zaj, et al., “Global analysis and prediction scenario of infectious outbreaks by recurrent dynamic model and machine learning models: A case study on COVID-19,” Computers in Biology and Medicine, vol.158, 2023.

L. D. Agati, Z. Benomar, F. Longo, et al., IoT/Cloud-Powered Crowdsourced Mobility Services for Green Smart Cities,” IEEE 20th International Symposium on Network Computing and Applications (NCA), pp.1-8, 2021.

R. K. Rathore, D. Mishra, P. Singh Mehra, et al., “Real-world model for bitcoin price prediction,” Information Processing & Management, vol.59, no.4, 2022.

A. Dutta, S. Kumar, M. Basu, “A Gated Recurrent Unit Approach to Bitcoin Price Prediction,” Journal of Risk and Finan-cial Management, vol.13, no.2, 2020.

J. J. Jaber, R. S. Alkhawaldeh, S. M. Alkhawaldeh, et al., “Chapter 133 Predicting Bitcoin Prices Using ANFIS and Haar Model,” Springer Science and Business Media LLC, vol.1056, 2023.

A. Ekstrom & H. Sorenason, “Statistical analyses,” The R Primer, pp.1-86, 2011.

K. Kamiya, K. Shimizu, A. Igarashi, et al., “Intraindividual comparison of changes in corneal biomechanical parameters after femtosecond lenticule extraction and small-incision lenticule extraction,” Journal of Cataract and Refractive Sur-gery, vol.40, no.6, pp.963-970, 2014.

A. Aljadani, “DLCP2F: a DL-based cryptocurrency price prediction framework,” Discover Artificial Intelligence, vol.2, no.1, 2022.

L. Raju, G. Sowmya, S. Srividhya, et al., “Advanced Home Automation Using Raspberry Pi and Machine Learning,” 7th International Conference on Electrical Energy Systems (ICEES), pp.600-605, 2021.

S. A. Reddy, S. Akashdeep, R. Harshvardhan, et al., “Stacking Deep learning and Machine learning models for short-term energy consumption forecasting,” Advanced Engineering Informatics, vol.52, 2022.

B. Panda, K. A. Haque, “Extended data dependency approach,” Proceedings of the ACM symposium on Applied com-puting, pp.446-452, 2002.

N. R. Shetty, L. M. Patnaik, N. H. Prasad, “Emerging Research in Computing, Information, Communication and Applica-tions,” Springer Science and Business Media LLC, vol.2, 2022.

A. Abdelsamea, A. A. El. Moursy, E. E. Hemayed, et al., “Virtual machine consolidation enhancement using hybrid re-gression algorithms,” Egyptian Informatics Journal, vol.18, no.3, pp.161-170, 2017.

M. J. Crawley, “Time Series Analysis,” The R Book, ISBN 978-0-470-97392-9 2007.

E. Akyildirim, A. Goncu, A. Sensoy. “Prediction of cryptocurrency returns using machine learning,” Annals of Operations Research, vol.297, pp.3-36, 2020.

S. M. Nally, J. Roche, S. Caton. “Predicting the Price of Bitcoin Using Machine Learning,” 26th Euromicro International Conference on Parallel, Distributed and Network-based Processing (PDP), pp.339-343, 2018.

Downloads

Published

How to Cite

CITATION COUNT

License

Copyright (c) 2023 Adnan Branković, Dr. Jukić Samed

This work is licensed under a Creative Commons Attribution 4.0 International License.